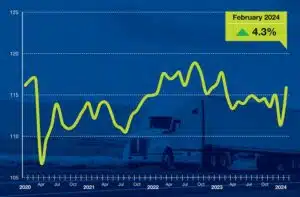

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 4.3% in February after decreasing 3.2% in January. In February, the index equaled 116.0 (2015=100) compared with 111.3 in January.

“After a very soft January, due in part to winter storms, truck tonnage snapped back in February,” said ATA Chief Economist Bob Costello. “February’s level was the highest in a year, yet the index still contracted from a year earlier, suggesting truck freight remains in a recession.”

January’s decrease was revised up from our February 20 press release.

Compared with February 2023, the index fell 1.4%, which was the twelfth straight year-over-year decline. In January, the index was down 4.5% from a year earlier.

The not-seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 109.7 in February, the same as in January. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

In calculating the index, 100 represents 2015.

Trucking serves as a barometer of the U.S. economy, representing 72.6% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 11.46 billion tons of freight in 2022. Motor carriers collected $940.8 billion, or 80.7% of total revenue earned by all transport modes.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.